Featured Speakers

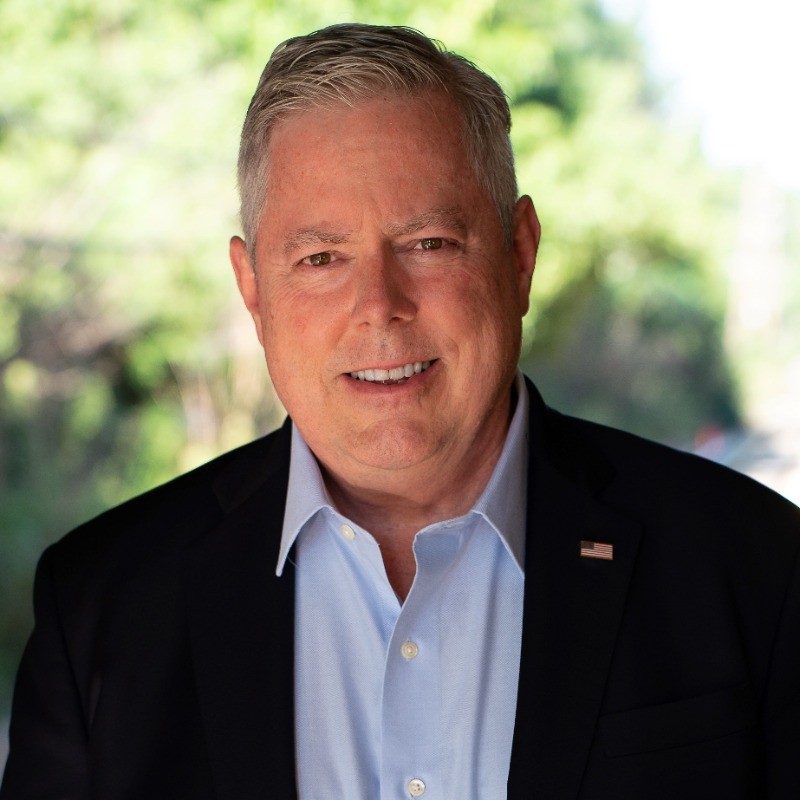

Mark T. Uyeda, Commissioner, U.S. Securities and Exchange Commission

Mark T. Uyeda was sworn into office as a Commissioner of the U.S. Securities and Exchange Commission on June 30, 2022, after being confirmed by the U.S. Senate. He was sworn in for a second term as Commissioner on December 28, 2023, after being confirmed by the U.S. Senate for a five-year term expiring in 2028.

Prior to becoming Commissioner, he served as an SEC detailee to both the legislative and executive branches, most recently as securities counsel to Ranking Member Pat Toomey on the U.S. Senate Committee on Banking, Housing, and Urban Affairs. Commissioner Uyeda also served on detail as a policy advisor to senior leadership at the U.S. Department of the Treasury in 2017-2018 and the U.S. Department of Labor in 2020. Commissioner Uyeda has been with the SEC since 2006, serving as Senior Advisor to Chairman Jay Clayton, Counsel to Commissioners Michael S. Piwowar and Paul S. Atkins, and Assistant Director and Senior Special Counsel in the Division of Investment Management.

Before joining the SEC, Commissioner Uyeda served as Chief Advisor to the California Corporations Commissioner, the state’s securities regulator, having been appointed by Governor Arnold Schwarzenegger in 2004. Earlier in his career, he worked as a corporate and securities attorney at Kirkpatrick & Lockhart (now K&L Gates) in Washington, D.C. and O’Melveny & Myers in Los Angeles.

Commissioner Uyeda earned his bachelor’s degree in business administration from Georgetown University in 1992 and his law degree with honors from Duke University in 1995. He is the first Asian-Pacific American to serve as a Commissioner at the SEC.

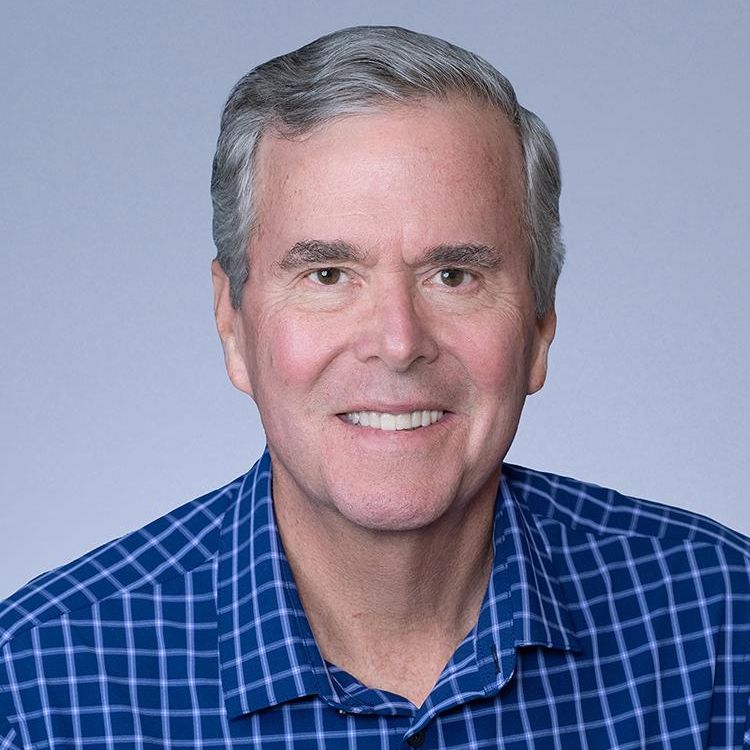

Jeb Bush, Former Governor of Florida

Governor Bush was the 43rd governor of the state of Florida, serving from 1999 through 2007. During his two terms, Governor Bush remained true to his conservative principles, cutting taxes, vetoing earmarks, and championing major reform of government programs.

Under his leadership, Florida was on the forefront of consumer healthcare advances, led the nation in job growth, and launched and accelerated restoration of America’s Everglades. In education, Florida raised academic standards, required accountability in public schools and created the most ambitious school choice programs in the nation. As a result, Florida students have made the greatest gains in academic achievement and Florida is one of a handful of states to significantly narrow the achievement gap.

Prior to and after his tenure as Florida’s chief executive, Governor Bush has been actively involved in the private sector, helping to build the largest full service real estate company in South Florida and owning and operating successful consulting and investing businesses. Governor Bush is also the Chairman and Founding Partner of Finback Investment Partners which is a private equity firm that takes active minority interest in middle market and growth-stage companies.

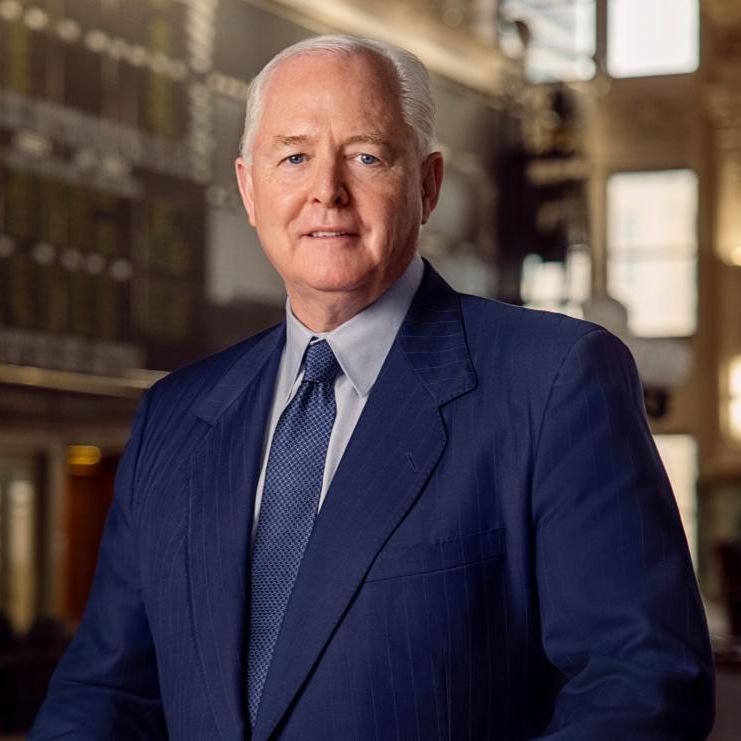

Thomas P. Gallagher, Chairman and CEO, Miami International Holdings, Inc.

Thomas P. Gallagher is one of the principal founders of and has served as the Chairman of the Board of Directors of MIH and the MIAX Exchanges since 2008. Mr. Gallagher has been serving as the Chief Executive Officer of MIH and the MIAX Exchanges since 2012. He was a founding partner of the law firm Gallagher, Briody & Butler, a corporate and securities law firm located in Princeton, New Jersey, and was associated with the firm until joining the Company full time in December 2012.

Mr. Gallagher has been a director of MGEX since October 2019, becoming Chairman of the MGEX Board of Directors in June 2021. Mr. Gallagher has also been a member of the BSX Council since July 2019, becoming Chairman of the BSX Council in February 2020. Mr. Gallagher is also the Chairman and Chief Executive Officer of the following subsidiaries of MIH: MIAX Technologies since May 2010; MIAX Products since January 2019; MIAX Global since June 2015; M 402 Holdings since July 2020; M 7 Holdings since December 2022; and Dorman Trading since October 2022. He is also the Chairman of M 9 Holdings since February 2008, becoming Chief Executive Officer in May 2024. He is also the Chairman of MIAXdx since June 2023. He is also a director of MIAX Futures Holdco and MGEX Real Estate Holdings. He is the Chief Executive Officer and a director of MIH East Holdings. From 2005 to 2014 Mr. Gallagher served on the Board of Trustees of The Hun School of Princeton and is currently a Trustee Emeritus.

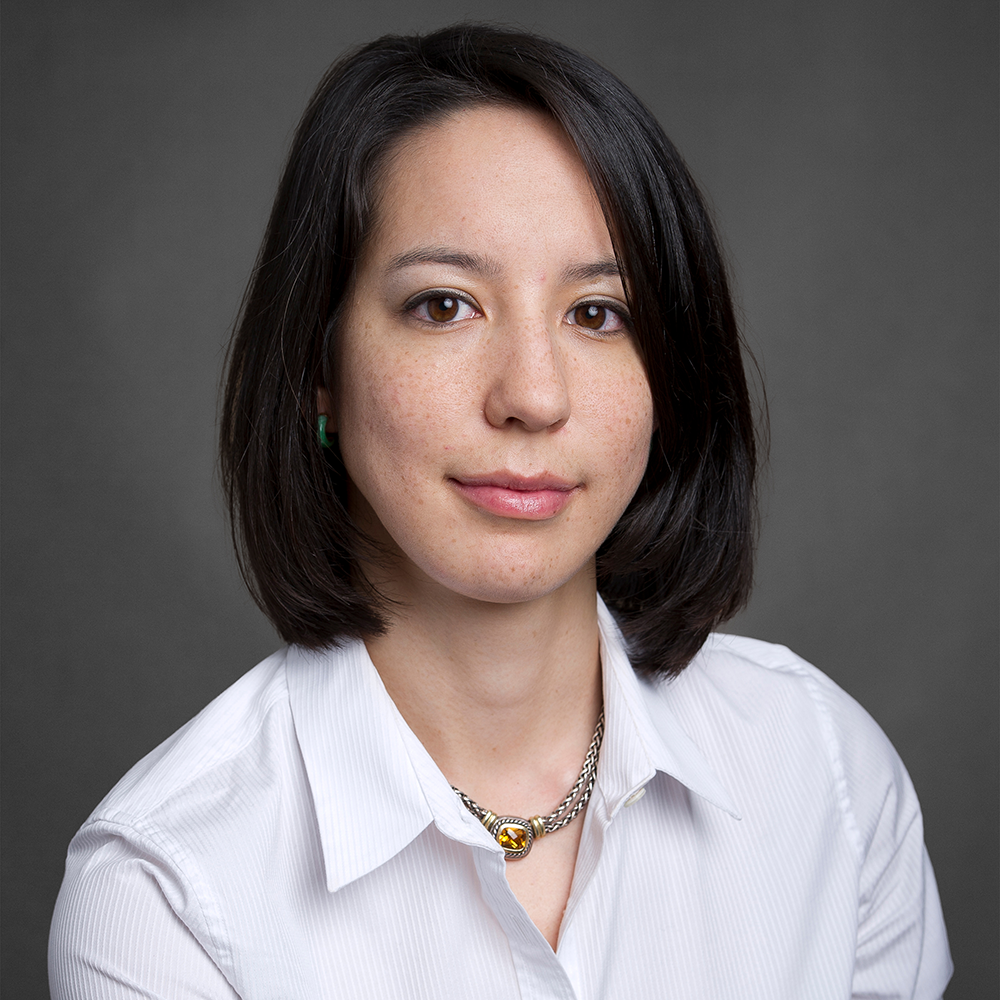

Dan Gallagher, Chief Legal, Compliance and Corporate Affairs Officer, Robinhood

Dan Gallagher is Chief Legal, Compliance and Corporate Affairs Officer of Robinhood Markets. Prior to joining Robinhood, Mr. Gallagher was Partner and Deputy Chair of the Securities Department at WilmerHale. He served as a Commissioner of the U.S. Securities and Exchange Commission (SEC) from 2011 to 2015 and held several other positions on the SEC staff prior to being appointed commissioner.

Mr. Gallagher’s previous experience includes serving as the Chief Legal Officer at Mylan N.V., a leading global pharmaceutical company, and as a President of a financial services consulting firm. Mr. Gallagher holds a J.D. from The Catholic University of America, Columbus School of Law and a B.A. from Georgetown University.

Brett Redfearn, Founder and CEO, Panorama Financial Markets Advisory

Prior to PFMA, Mr. Redfearn headed Capital Markets for Coinbase, where he focused on building the emergent ecosystem for digital asset securities and overseeing the Coinbase exchange. Between October 2017 and December 2020, Mr. Redfearn led the U.S. Securities and Exchange Commission’s Division of Trading and Markets where he oversaw several groundbreaking rulemakings and market initiatives.

Mr. Redfearn joined the SEC after a 14-year career at J.P. Morgan, where he was, most recently, Global Head of Market Structure for the Corporate and Investment Bank across asset classes.

Peter Schweizer, Co-Founder and President, Government Accountability Institute

Peter Schweizer is the co-founder and President of the Government Accountability Institute. He is the author of seven New York Times bestsellers, including Blood Money, Red Handed, Profiles in Corruption, and Secret Empires. Red Handed was the #1 bestselling political book of the year in 2022, according to Publisher’s Weekly.

Between 1999 and 2015, he was a research fellow and then the William J. Casey Fellow at the Hoover Institution, Stanford University. He was a consultant to the Office of Presidential Speechwriting in the White House from 2008-2009.

His books have directly impacted the national discourse and have been featured twice on CBS’s “60 Minutes” as well as on the front pages of The New York Times and Wall Street Journal. Throw Them All Out exposed insider trading on the stock market by members of Congress and was credited with leading to the passage of the STOCK Act, which restricted such practices.

He is the author or co-author of 16 books. His written work has also appeared in Foreign Affairs, New York Times, The Wall Street Journal, The Washington Post, Defense Nationale (France), ORBIS: A Journal of World Affairs, National Review, and more. He received his M.Phil. in International Relations from Oxford University and his B.A. from George Washington University.

Speakers

Arianne Adams, Chief Strategy Officer, Webull Financial

Arianne Adams has served as the Chief Strategy Officer of Webull US since January 2024. Prior to joining Webull, Ms. Adams was most recently Senior Vice President, Head of Derivatives and Global Client Services at Cboe Global Markets, Inc. where she was responsible for the management, revenue and operations of the options and futures businesses. She also led the sales, coverage and market structure teams to identify, support, and expand the use of derivatives products globally. Prior to that, Adams worked for Goldman Sachs from 2010 to 2018 where she was Head of Electronic Options Sales.

Prior to joining Goldman Sachs, Adams joined a start-up broker-dealer at Capstone Global Markets, where she was part of team that established the framework, onboarded accounts and traded for institutional asset managers. Adams started her career at Merrill Lynch, where spent nine years from 2000 to 2009 in several disciplines, including Equity Derivatives Sales Trading, Debt Capital Markets & Syndicate and Middle Markets Mergers & Acquisitions. Ms. Adams attended Pennsylvania State University, where she earned a B.S. in Finance and Minor in Economics in 1999. She was a member of Penn State Women’s Swim Team for four years and served as captain her senior year.

Julie Andress, Director, Institutional Equity Sales Trading, KeyBanc Capital Markets

Julie Andress is a Director, Institutional Equity Sales Trading at KeyBanc Capital Markets Inc. She is responsible for managing institutional investor, accounts, providing research commentary and overseeing best execution trading. Prior to joining KBCM in 2011, she served as a senior account manager with Bloomberg LP. Ms. Andress has been an active member of STA for more than a decade. She has served on the board of the Ohio Security Traders Association since 2014, she has held the roles of Treasurer, Vice President, and is a current Governor. In 2016, she was named “Rising Star” by Markets Media. Ms. Andress is a committee member for the STA Women in Finance, joining as an affiliate member in 2015 and committee member since 2016. She is a member of Key Women’s Network.

Ms. Andress is a very involved community member. In 2015, she was recognized for her fundraising efforts for the Cystic Fibrosis Foundation being named Northeastern Ohio’s “Young Professional of the Year” and nationally “CF Finest.” In 2016, she co-founded the associate board of The Transplant House of Cleveland, an organization that provides temporary housing and supportive community to organ transplant patients and their families. She is a graduate of John Carroll University.

Lauren Arbid, U.S. Head of Relationship Management

Mrs. Arbid is the U.S. Head of Relationship Management for ABN AMRO Clearing USA where she has been employed for 10+ years. Active with the Security Traders Association (STA); she is currently serving as President for the Chicago chapter (STAC). Mrs. Arbid is a graduate of the University of Maryland; College Park with a Bachelor of Arts degree in Economics and holds Series 3, 7, 63, and 24 registrations.

Ashley Banfield, Co-Head, Global Execution Strategy, Fidelity Investments

Ashley Banfield is Co-Head of Global Execution Strategy in the Equity division at Fidelity Investments. In her role, Ms. Banfield is responsible for overseeing the day-to-day operations of the Global Trading desk and engaging across the industry on topics relating to Equity Market Structure. Prior to joining Fidelity in 2013, Ms. Banfield served as an executive director at Morgan Stanley in New York. She has been in the financial industry since 2005. Ms. Banfield earned her bachelor of arts degree in economics from Harvard and her master of business administration degree from Columbia University.

Matt Billings, Vice President, Brokerage and President, Robinhood Financial and Robinhood Securities, Robinhood

Mr. Billings began his career on the exchange floors in Chicago more than 30 years ago. His long-standing and hands-on experience in the mechanics of trading, coupled with extensive industry engagement and regulatory insight, fuel Mr. Billings’ unique perspective on how the markets operate and impact traders and investors.

Mr. Billings recently joined Robinhood Markets as President of Robinhood Financial and Robinhood Securities. Prior to Robinhood, Mr. Billings worked on Two Sigma Securities’ Wholesale Market Making team. His areas of oversight included the trade/service desks as well as client relationships. Mr. Billings also focused on market structure, and in particular market data. Prior to Two Sigma Securities, Mr. Billings led the team overseeing market data at TD Ameritrade. He managed all aspects of the firm’s market data strategy as well as contributed to the areas of government relations and market structure. Before TD Ameritrade, Mr. Billings managed Trading Services for Scottrade for over 10 years, accountable for several areas including order routing & execution quality and market data.

Mr. Billings is an active member of several trade organizations including STA, FIF & SIFMA. He maintains his Series 7, 4, 24, 57 and 63 registrations, completed an Executive Leadership Development course through Washington University, completed the three-year Securities Industry Institute course sponsored by SIFMA and The Wharton School, and earned a Bachelor’s degree from Saint Norbert College in De Pere, Wis., and a Masters of Business Administration degree from DePaul University in Chicago.

Chris Clark, ETF Strategist, Jane Street

Chris Clark is an ETF Strategist within Jane Street’s Institutional team. In this role, Mr. Clark analyzes market structure and ETF trading developments, as well as produces market studies and commentary for institutional clients including global asset managers, pension funds, insurance companies, and wealth platforms.

Prior to joining Jane Street in 2019, Mr. Clark spent 7 years at Oppenheimer Funds and Invesco, where he held multiple roles across the organization including ETF strategy and product management. Mr. Clark holds a BBA in Finance from George Washington University.

Cromwell Coulson, President and CEO, OTC Markets Group

R. Cromwell Coulson is President, CEO and a Director of OTC Markets Group, responsible for the company’s overall growth and strategic direction. Since leading the acquisition of OTC Markets’ predecessor business in 1997, Mr. Coulson has transformed the company from a privately-held publisher of broker-dealer quotations into a publicly-traded company operating data-driven markets for 12,000 securities that trade $386 billion in dollar volume annually. Mr. Coulson is a strong advocate of improving capital formation, supporting a diverse ecosystem of broker-dealers, and empowering investors with increased disclosure and transparency.

He has testified before Congress and spoken on these and other issues at numerous industry conferences. Mr. Coulson is currently the Co-chair of the STANY Market Structure Committee and a former Chair (2017-2018) of the FINRA Market Regulation Committee that advises FINRA on rulemaking and trading issues. Prior to OTC Markets, Mr. Coulson was an institutional trader and portfolio manager at Carr Securities Corporation. He holds an OPM from Harvard Business School and received his BBA from Southern Methodist University.

Shawn Cruz, Business Development Lead, IMC

Shawn Cruz is the Business Development Lead, and is responsible for facilitating IMC’s derivatives business expansion by building new partnerships and emerging into new areas. He currently serves as Vice-Chairman on the Security Traders Association Listed Options Committee. Previously, Mr. Cruz held various roles in the Trader Group at TD Ameritrade and Charles Schwab. Mr. Cruz has an Economics and Finance degree from Illinois State University and an MBA from University of Chicago. Mr. Cruz is series 7, 57, and 24 licensed.

Jessica D’Alton, Executive Director, Head of Market Structure & Liquidity Strategy, Americas, UBS

Jessica D’Alton is the Head of Americas Market Structure and Liquidity Strategy at UBS, based in New York. She advises both clients and internal groups on market structure, liquidity trends and regulatory changes. Ms. D’Alton is a member of IEX’s Quality of Markets Committee, Cboe’s Equity Advisory Committee and New York Stock Exchange and NYSE American Director Candidate Recommendation Committees.

Prior to her current role, she was on the Equities Advisory Compliance team where she provided real-time guidance to trading desks on regulatory requirements, rule changes and interpretations. Ms. D’Alton joined UBS in 2011 from AllianceBernstein where she spent four years at the firm. There she worked in Client Services where she acted as a liaison between portfolio managers and advisors to ensure client investment objectives were met and Trade Compliance where she was responsible for monitoring guidelines for 1940 act mutual funds.

Armando Diaz, CEO, PureStream

Armando Diaz is CEO of PureStream, an innovative trading venue focused on increasing direct institutional to institutional liquidity discovery by enabling broker algorithmic orders to search, find, and yield more liquidity without self-inflicted price impact.

Mr. Diaz began his career as a Trader for Goldman Sachs and was ultimately promoted to Partner and Co-Head of US Equity Trading. In addition, he served on Goldman Sachs’s Firmwide Diversity Committee and was a Board Member of Goldman Sachs’s leadership development initiative, Pine Street.

In 2008, Mr. Diaz joined Citigroup as the Head of Trading. He played a key role in the creation and implementation of TotalTouch, the industry’s first fully electronic high touch product which integrates the best elements of electronic (low touch) and high touch trading. Mr. Diaz left Citi to become the Global Head of Execution Services at Millennium Partners, a multi strategy hedge fund. He served on several of the firm’s committees including the Executive Committee, Risk Committee, Best Execution Committee, and Operational Risk Committee.

John DiBacco, Global Head of Derivatives, Clear Street

John DiBacco is Clear Street’s Global Head of Derivatives. Mr. DiBacco has more than 25 years of experience in capital markets and brings a wealth of expertise in the derivatives industry. A graduate of the Massachusetts Institute of Technology, Mr. DiBacco has held significant leadership roles at Chicago Trading Company, UBS, and Virtu Financial, where he built out the automated ETF block quoting, hedging, and central risk.

Mr. DiBacco is actively involved in the ETF industry and works closely with regulators to help build a better ETF ecosystem and improve market structure. His strategic vision and deep knowledge of the derivatives market supports Clear Street’s growth and success in the derivatives market.

Geralyn Endo, Head of Options Business Development, MEMX Exchange

Geralyn Endo is the Head of Options Business Development at MEMX. Prior to MEMX, Ms. Endo was Global Head of Client Engagement, Cboe Data and Access Solutions, where she established and maintained collaborative client relationships and service, while driving the team’s strategy and product development. Ms. Endo joined Cboe as part of Cboe’s U.S. options business development team before transitioning to Data and Access Solutions. Ms. Endo has held several roles options focused roles at Credit Suisse, Bank of America Merrill Lynch and the International Securities Exchange (ISE), a Nasdaq subsidiary. Ms. Endo holds a B.S. degree in Finance and Psychology from Boston College.

Summer Germann, Founder, Brave Gowns

Summer Germann is the founder of Brave Gowns, a company dedicated to bringing comfort and dignity to children facing serious illnesses. Her journey began with a deeply personal experience—the loss of her younger brother to cancer. Witnessing firsthand the challenges and fears that children endure during hospital stays, Ms. Germann was inspired to create a solution that could bring a sense of normalcy and empowerment to these young patients.

With a background in design and an unyielding commitment to making a difference, Ms. Germann launched Brave Gowns in 2015. Her innovative designs transform traditional hospital gowns into vibrant, fun, and empowering garments that allow children to feel like superheroes, princesses, and more—offering them not just comfort, but also a sense of identity and strength.

Under Ms. Germann’s leadership, Brave Gowns has grown into an internationally recognized brand, making a positive impact in hospitals across the United States and beyond. Her work has been featured in numerous media outlets, and she continues to advocate for the well-being of children in medical care.

Ms. Germann’s mission goes beyond clothing; she is dedicated to changing the way children experience illness, providing them with the emotional support they need to face their battles with courage. Her unwavering dedication to this cause has made her a beloved figure in the pediatric healthcare community, and her work continues to inspire countless others to join in the fight for a brighter, more hopeful future for all children.

Chris Halverson, Director, Institutional Sales, CAPIS

Chris Halverson joined CAPIS in 1999. He began his career at the Chicago Board of Trade (CBOT), advising institutional accounts on hedging in the futures markets. Today, Mr. Halverson is a trusted resource for a variety of firms, including investment managers, plans sponsors, and consultants. Mr. Halverson has been actively involved with the Security Traders Association (STA) for many years. He joined the Board of Directors of STA’s local affiliate, the DSTA, in 2008 and served as its President in 2014. Shortly after that, Mr. Halverson joined the STA National Board of Directors and was elected STA Chairman in 2020. He continues to be an advocate for STA and serve on the DSTA Board. Mr. Halverson graduated with a bachelor’s degree in finance and economics from Spring Hill College in Mobile, Alabama. He and his wife Julie have two daughters, Lauren and Caroline, who keep them extremely busy. In his spare time, Mr. Halverson enjoys golf, tennis, snowboarding, scuba diving and travel.

Brian Hyndman, President and CEO, Blue Ocean Technologies

Brian Hyndman is the President and Chief Executive Officer for BOT. Previously, Mr. Hyndman was the Senior Vice President of Global Information Services for The NASDAQ OMX Group, Inc. In this role, he was responsible for the creation and dissemination of valuable information from the quoting and trading in NASDAQ OMX’s trading systems worldwide. Mr. Hyndman oversees various internal teams, including Sales, Product Management, Content Administration & Policy, and New Business Development. He previously served as Senior Vice President of Transaction Services and was responsible for managing operations of U.S. equities trading platforms including The NASDAQ Stock Market, NASDAQ OMX BX and NASDAQ OMX PSX.

Prior to joining NASDAQ in 2004, Mr. Hyndman was the President of BRUT, an electronic communications network (ECN) that competed with the various equity markets in the U.S. He presided over the BRUT’s merger with Strike Technologies in 2000, the sale of BRUT to SunGard Data Systems in 2002 and the eventual sale of BRUT to The NASDAQ Stock Market in 2004. Prior to joining BRUT, Mr. Hyndman served as Vice President of Execution Services for the National Discount Brokers Group, managing 120 employees.

He holds a Bachelor of Arts degree in Psychology from the State University of New York at Oswego. Mr. Hyndman has held a variety of FINRA licenses and from the National Association of Securities Dealers, including the 4, 7, 24, 27, 53 and 63.

James Hyde, Head of Business Development and Strategic Partnerships, NYSE

James Hyde is the former Vice Chairman of the American Stock Exchange Board and Senior Supervisory Officer on the Trading Floor. Prior to the closing of the NYSE Euronext/AMEX transaction, he was asked to serve as liaison among NYSE Euronext senior staff. Concurrently he was also a Registered Options Trader for Integral derivatives LLC. As a founding member of Hyedge LLC (1998), Mr. Hyde was able to utilize his options trading experience to develop and market proprietary algorithmic-like scripting technologies.

Prior to trading for ID Specialists, Mr. Hyde was a Senior Managing Director of Kellogg Capital Group, L.L.C., which he helped build into one of the top-tier Option Specialists on the American Stock Exchange. He was instrumental in launching Kellogg into the Option, ETF and broker business, through acquisitions of Knight Securities, Spear Leads and Kellogg Index products, the Fogel Group, and the Van Der Moolen Company. Additionally, Mr. Hyde is co-founder of TAHOE Trading LLC and TAHOE Technologies, a proprietary analytical software platform utilized in the market today. Also, in 2005 Mr. Hyde negotiated and closed the transaction transferring control of the American Stock Exchange back to the members.

Mr. Hyde’s day to day responsibilities include supporting and interacting with the various exchange constituencies – regulatory, legal, marketing, and technology. Specifically, as it relates to technology, he plays a critical role in coordinating, designing and rolling out customized proprietary trading technologies which are vital to the Exchange’s forward-looking business initiatives relating to options trading. Mr. Hyde is currently serving on the STANY board, which was founded in 1937.

Adam Inzirillo, Executive Vice President, Global Head of Data & Access Solutions, Cboe Global Markets

Adam Inzirillo is Executive Vice President, Global Head of Data & Access Solutions at Cboe Global Markets. He has led a distinguished 20-year career in equities trading and held a number of senior leadership positions in the industry. Prior to joining Cboe, Mr. Inzirillo was Managing Director, Head of Order Routing and Execution Products at Bank of America Merrill Lynch (BAML), where he worked for nearly a decade. During his tenure, he expanded the firm’s liquidity offerings via business development and product management of its smart order router, direct market access, order management applications and non-displayed crossing functionality.

He also served as a Director of the Members Exchange (MEMX) and was instrumental in BAMLs strategic investment. Previously, he was Executive Director, Head of Broker Dealer Business Development at UBS Securities LLC, where he managed the business development of broker dealers trading on the firms ATS and electronic trading platforms. He also recently held memberships with the Cboe Equities Advisory Committee, NASDAQ Quality of Markets, IEX Quality of Markets, and Level ATS Board.

Aaron Kehoe, Head of QwickRoute, MCAP Execution Services

Aaron Kehoe leads QwickRoute, the Execution Services Division of MCAP, where he drives the development of custom algorithmic trading solutions for institutional investors and broker-dealers. Under his leadership, QwickRoute focuses on enhancing trading performance by optimizing workflows, improving execution quality, sourcing liquidity, and crafting best execution strategies by listening to client needs. With over 20 years of experience, Mr. Kehoe has been a pioneer in developing technology and operations that support ETF trading systems. His deep understanding of how various asset classes trade has allowed him to continuously improve ETF trading and execution practices, consistently solving complex workflow issues and driving industry-wide innovation.

Mr. Kehoe’s career began on the trading floor of the AMEX as an ETF trader, where he quickly distinguished himself before becoming an ETF specialist on the NYSE. His extensive career includes senior roles at Bear Stearns, NewEdge, Virtu (formerly Knight), Cantor Fitzgerald, and Brownstone Investment Group.

Mehmet Kinak, Global Head of Equity Trading, T. Rowe Price

Mehmet Kinak is the Global Head of Equity Trading at T. Rowe Price. Mr. Kinak’s primary focus is electronic and program trading, market structure analysis, and transaction cost analysis. He is the Co-Chair of the NYSE Institutional Traders Advisory Committee and serves on the Institutional Traders Advisory Committees of CBOE Global Markets, IEX Group, and Nasdaq. Mr. Kinak previously served as a member of the SEC Equity Market Structure Advisory Committee. He is a board member of the National Organization of Investment Professionals (NOIP) and Chairs ICI’s Equity Market Structure Advisory Committee.

Mr. Kinak joined the firm in 2000 and worked as a portfolio accounting associate, investment liaison, portfolio implementation manager, and electronic trader before assuming his current role in 2014. Mr. Kinak earned a B.S. in finance from Virginia Polytechnic University.

Elisabeth Kirby, Head of Market Structure, Tradeweb

Elisabeth Kirby is Head of Market Structure at Tradeweb. She was previously Managing Director, Head of U.S. Rates Strategy and Product Management, focusing on the development of the electronic trading business for U.S. Markets. Ms. Kirby joined Tradeweb in 2011 as a Vice President, supporting market strategy and working on integrated solutions to build and bolster functionality across Tradeweb’s Rates platforms.

She was an integral part of the Tradeweb team that helped develop and launch the firm’s leading swap execution facilities (SEFs), supporting electronic trading of derivatives as mandated by the Dodd-Frank Act. Ms. has a track record of developing innovative trading and workflow solutions, including Tradeweb’s market leading compression tool for derivatives. Prior to joining Tradeweb, she worked in the Capital Markets Structuring group at BNP Paribas. Ms. Kirby was recognized by the Markets Media Women in Finance Markets Choice Awards as a Rising Star in 2016 and for Excellence in Product Management in 2017, and she has served as a speaker at multiple industry events, including FIA EXPO, ISDA North America, the FIA-SIFMA Asset Management Derivatives Forum, and the Credit Suisse Global Trading Forum.

Ms. Kirby holds a B.S. in Finance from Boston College and earned her M.S. in Accounting and Finance from the London School of Economics.

Ben Klixbull, Head of Distribution & Liquidity Management Americas, XTX Markets

Ben Klixbull is Head of Distribution and Liquidity Management for the Americas at XTX Markets – the leading global electronic liquidity provider. Previously he was in FX, Rates and Credit e-trading at UBS and prior to that, was a Quant Analyst at Louis Dreyfus Highbridge Energy. XTX Markets is a leading quantitative-driven electronic liquidity provider partnering with counterparties, exchanges and e-trading venues globally to provide liquidity across asset classes.

Ryan Kwiatkowski, Managing Director, Head of Broker Dealer Sales, StoneX Financial Inc.

Ryan Kwiatkowski is Managing Director, Head of Broker Dealer Sales at StoneX Financial in Winter Park, Florida. He has 22 years of industry experience in equity trading and sales. Mr. Kwiatkowski began his career at Raymond James Financial in the Equity Capital Markets Division as a broker dealer sales specialist then joined StoneX Financial in 2005 where he continues his career. His focus area is in international equities. Mr. Kwiatkowski has been involved with Security Traders Association of Florida since 2000 and is a former President of STAF. Mr. Kwiatkowski holds a Bachelor of Arts in History from the University of South Florida and a Masters of Business Administration from Tampa College.

Rebecca Lahar, Vice President, Equity Trading, T. Rowe Price

Rebecca Lahar is a senior equity trader in the Global Trading department. She is a Vice President of T. Rowe Price Group, Inc. and is the primary trader for the Large Cap Value Fund, Global Tech Fund, and Science and Tech Fund with a desk sector specialty in the Technology sector. Outside of her investment responsibilities, she is a mentor for new hires in the T. Rowe Price Fellows Program. Her investment experience began in 2006, and she has been with T. Rowe Price since 2011, beginning in the Global Trading Group. Prior to this, Ms. Lahar was employed by Knight Capital Asia Limited in Hong Kong as an institutional equity trader. Ms. Lahar earned a B.S. in Economics from Colgate University and a Master’s In Finance degree from the Johns Hopkins University Carey School of Business.

Krista Lynch, Vice President, ETF Capital Markets, Grayscale Investments

Krista Lynch is a Vice President on Grayscale Investments’ ETF team, focusing on Capital Markets. Ms. Lynch works with Authorized Participants, ETF market makers, and digital asset liquidity providers to ensure healthy trading of Grayscale’s ETFs and to grow the ecosystem surrounding Grayscale’s products. Prior to joining Grayscale, Ms. Lynch was a Vice President at BlackRock, where she led daily primary market trading for iShares fixed income ETFs. Ms. Lynch holds a BSBA in Finance & Accounting from the University of Miami.

Chuck Mack, VP & Head of Strategy for North American Market Services, Nasdaq

Chuck Mack is VP & Head of Strategy for North American Market Services at Nasdaq. He is responsible for strategic direction for the businesses in North America as well as public policy and capital allocation. Previous to his current role, Mr. Mackwas head of US Equities for Nasdaq, where he was responsible for the management, operation and strategic direction for Nasdaq’s US Equities Transaction Business across three U.S. equities exchanges–Nasdaq, BX and PSX. In addition, he oversaw the exchange traded product (ETP) and over-the-counter Trade Reporting Facility (TRF) businesses.

Mr. Mack has over 20 years of experience within financial markets, most of which have been with Nasdaq. At Nasdaq, Mr. Mack has held various operational, management, and market structure roles across equities, options and futures. Mr. Mack Began his career in the securities industry in trading and technology at TD Waterhouse Inc. and holds a Bachelor of Arts and aMasters of Business Administration from Rutgers University.

Jimmy McGrail, Managing Director, Business Development & Liquidity Strategy, IntelligentCross

Jimmy McGrail joined IntelligentCross in 2023, and is responsible for the growth and strategic relationships at the #2 US Equity ATS, according to FINRA’s weekly ATS reports. Mr. McGrail brings over 15 years of experience in Equity Trading, previously working for brands such as RBC, Barclays and Level. He is an expert in market structure and electronic trading, equally comfortable working with buy side, sell side, market makers, and other key stakeholders. Mr. McGrail is singularly client focused; his knowledge of the industry as well as the requirements for electronic trading enables him to be an advocate for the subscriber, as well as an insightful consultant regarding how best to access the Performant Liquidity available at IntelligentCross. He graduated with a B.A. in Economics from Fordham University.

Joe Mecane, Head of Execution Services, Citadel Securities

Joseph Mecane is Head of Execution Services at Citadel Securities. In this role, he is responsible for the firm’s client-facing equity, options, FX, and ETF businesses.

Prior to joining the firm, Mr. Mecane was Global Head of Electronic Equities at Barclays. Previously, he worked for the New York Stock Exchange (NYSE) for six years, most recently serving as the Head of U.S. Equities. His earlier career included roles at UBS Securities, Schwab Capital Markets, Knight Capital Group and Price Waterhouse.

Mr. Mecane is involved with numerous industry organizations, currently serving as Chairman of the Nasdaq Quality of Markets Committee and serving on the FINRA Board of Governors, the Nasdaq Exchange Board, and the Board of Trustees for the Museum of American Finance. He is also a member of the National Organization of Investment Professionals and the SIFMAAdvisory Council. He was previously a member of the SEC’s Equity Market Structure Advisory Committee and a member of the Nasdaq Exchange Board and BATS Exchange Board.

Mr. Mecane received an MBA, with honors, from the Wharton School of the University ofPennsylvania and a bachelor’s degree from Pace University.

Ovi Montemayor, Managing Director, Market & Execution Services, Charles Schwab

Ovidio Montemayor has over 20 years of corporate experience in retail brokerage at TD Ameritrade, which was acquired by Charles Schwab. Mr. Montemayor manages the firm’s trading operations and order routing functions, which serve as liaisons to the markets and manages market center relationships to satisfy the company’s order routing obligations and practices.

Mr. Montemayor is a member of multiple financial services industry trade organizations, including the SIFMA Listed Options Trading Committee. He completed the Securities Industry Institute Program at The Wharton School and the Professional Leadership Develop Program at Cornell University. He holds a Bachelor of Business Management degree from Northwood University.

Joel Oswald, Principal, Williams & Jensen

Prior to joining Williams & Jensen, Mr. Oswald worked as a Legislative Assistant for Senator Michael B. Enzi (R-WY) covering a range of issues including financial services and foreign affairs. He then served as Professional Staff on the Senate Subcommittee on International Trade and Finance, Committee on Banking, Housing, and Urban Affairs, where he took a leading staff role in the effort to reauthorize the Export Administration Act (EAA). In 2001, Mr. Oswald served as Professional Staff to the Senate Subcommittee on Securities and Investment, Committee on Banking, Housing, and Urban Affairs, under the Chairmanship of Senator Michael B. Enzi.

Sapna C. Patel, Head of Americas Market Structure and Liquidity Strategy, Morgan Stanley

Sapna C. Patel is the Head of Market Structure and Liquidity Strategy at Morgan Stanley for the Americas and is an Executive Director on the Morgan Stanley Electronic Trading desk. In her current role, Ms. Patel focuses on market structure issues, regulatory developments, order routing and liquidity strategies, as well as business development.

Prior to joining the desk in 2008, Ms. Patel spent three years as an institutional equities coverage attorney in the Morgan Stanley Legal and Compliance Division. Ms. Patel began her career at the U.S. Securities and Exchange Commission in the Division of Trading and Markets (formerly the Division of Market Regulation) and held various positions during her five years at the agency.

Ms. Patel currently is the Chair of the SIFMA Equity Markets and Trading Committee and previously served as the Chair of the FINRA Market Regulation Committee. She also participates on the STA Market Structure Analyst Committee and on the Cboe Equity Advisory Committee, and is a member of the National Organization of Industry Professionals.

Ms. Patel serves on the Markets Media Women in Finance Board and was the recipient of the Markets Media Women in Finance 2015 Excellence in Market Structure award. Ms. Patel holds a Juris Doctorate degree from the University of Maryland School of Law and Bachelor of Science degrees in Criminal Justice and Psychology from American University.

Eric Pollackov, Global Head of ETF Capital Markets, Invesco ETFs

Eric Pollackov is the Global Head of ETF Capital Markets for Invesco ETFs. In this role, Mr. Pollackov proactively develops relationships with sell-side trading desks and Exchanges, implements capital markets strategies for Invesco’s ETFs, and develops and measures the success of client business plans.

Before joining Invesco in 2016, Mr. Pollackov was head of ETF capital markets for Charles Schwab Investment Management. Previously, he served as managing director of exchange-traded products at NYSE Euronext. He began his career as a derivatives trader for Susquehanna International Group (SIG), specializing in ETFs, options and futures trading.

Mr. Pollackov earned a bachelor’s degree from The State University of New York at Buffalo and holds the Series 7 and 24 registrations. Mr. Pollackov is also chair of the Securities Traders Association ETP Working Group and actively mentors post-9/11 veterans looking to enter the financial industry via American Corporate Partners (ACP).

Alan Polo, Head of Equities Sales and Trading, Americas, Liquidnet

Alan Polo is the Head of Equities Sales and Trading, Americas. He is responsible for the growth and development of the Liquidnet equities business in the region, a trading network that includes more than 1,000 global Member firms that collectively manage $26+ trillion1 in Equities assets. Based in New York, Mr. Polo’s immediate focus is providing asset managers with deep institutional-sized liquidity and value-added execution services.

Mr. Polo brings over 20 years of experience in the financial services industry with a focus on electronic trading, trading analytics and market structure. Prior to joining Liquidnet, Mr. Polo was a Managing Director, Global Head of Account Management at Enfusion where he grew and developed Enfusion’s global team of Account Managers and Technical Account Managers.

Previously, Mr. Polo was a Director of Global Electronic Sales and Trading at Sanford Bernstein, where he cared for the equity trading needs of institutional asset managers and hedge funds. Prior to Bernstein Mr. Polo was a Managing Director in the Global Electronic Sales and Trading team at ITG and a Senior Vice President at Lehman Brothers within their Electronic Trading group.

Earlier in his career, Mr. Polo spent time at O/EMS vendors such as LongView/LineData Systems and Merrin Financial/Macgregor Group. He started his career in equity settlements teams for Fidelity Investments and John Hancock Funds.

Mr. Polo holds a bachelor’s degree in Finance and International Business from Northeastern University’s D’Amore-McKim School of Business.

Joe Pleffner, Head of Wholesale Market Making, GTS Securities

Joe Pleffner currently serves as the Head of GTS Securities Wholesale Market Making (WMM) where he primarily focuses on trading, risk management, and sales. Under his leadership and vast network of client relationships, the GTS WMM team has grown into an industry leader in a very short period of time, providing innovative products to an array of broker-dealer clients. He is also responsible for the firm’s sales and trading efforts for digital assets.

Prior to GTS and before a three-year stint at Cantor Fitzgerald as the Head of Client Market Making, Mr. Pleffner worked at Knight Capital Group (KCG) for close to 20 years serving as both Head of Cash Trading strategy and MD of trading operations. In these roles, he was involved in every aspect of the Client Market Making business – leading the trading staff, driving technology requirements and solutions, identifying new opportunities to grow the P&L and ensuring client retention and satisfaction.

Through his 25-year career in execution services, Mr. Pleffner has developed a seasoned perspective on market structure best-practices, client relationship management and regulatory and operational awareness.

Mr. Pleffner graduated from Hofstra University with a bachelor’s in economics.

Jacob H. Rappaport, Global Head of Equities, StoneX Financial Inc.

Jacob Rappaport serves as the Global Head of Equites at StoneX Group Inc. (NASDAQ: SNEX), a Fortune® 100 company and leading provider of financial-services execution, risk management, market intelligence, and post-trade services across asset classes and markets around the world. Mr. Rappaport is responsible for the company’s Equities businesses globally, which include, Wholesale Market Making, Global Institutional Sales & Trading, Electronic Trading, Outsourced Trading, and Global Macro Commentary. He has held various roles at StoneX and predecessor companies since joining in 2005, including Head of Americas Trading, and Head of Market Making. Since taking the role of Head of Equities in 2013, the segment has multiplied revenue more than ten times and became the number one ranking market maker in ADRs and foreign securities traded OTC.

Mr. Rappaport serves as a member of the StoneX Group Inc. Management Committee and is an Officer of the wholly owned subsidiary, StoneX Financial Inc., a FINRA registered Broker Dealer. He also served as President of the Florida affiliate of the Securities Traders Association from 2015 through 2017 and is a member of the SIFMA Equity Market Structure Committee and Low-Priced-Securities Task Force. Mr. Rappaport is an Advisory Board Member for the Department of Business at Rollins College, where he earned his BA in International Business.

Joyce Rosely, Senior Relationship Manager, MarketAxess

Joyce Rosely has a wealth of experience across the financial industry, with a focus in asset management, sales and trading. Ms. Rosely currently holds the position of Senior Relationship Manager at MarketAxess, leading the RFQ-Hub Sales effort, a role she began in August 2023.

Prior to this, Ms. Rosely was the Executive Vice President and Co-Head of Institutional Sales and Distribution at Strive Asset Management and held a prominent role as the Head of Asset Management/Hedge Fund Sales for US SPDRs at State Street Global Advisors. Before joining State Street, she worked at both Tradeweb and Convergex as a Managing Director. Ms. Rosely’s earlier career includes positions at CIBC Capital Markets as the Executive Director and Head of Global Portfolio Sales & Execution and Director at Deutsche Bank. Ms Rosely started her career at Goldman Sachs, where she worked for 14 years across the sales and trading division as well as electronic execution services.

Ms. Rosely pursued her Bachelor of Arts (B.A.) degree in History at Hobart and William Smith Colleges.

Kimberly Russell, Head of ETF Markets Advocacy, State Street Global Advisors

Kimberly Russell is Vice President and Head of ETF Markets Advocacy at State Street Global Advisors. Her team is responsible for analyzing global market structure and regulatory developments impacting liquidity of exchange-traded funds (ETFs) and advocating for ETF investors in market structure and regulatory discussions.

Prior to joining State Street, Ms. Russell spent nine years at Barclays Capital Inc., most recently as a Director in the Equities Execution division. She started her career at Lehman Brothers in real estate investment banking in 2008.

Outside of work, Ms. Russell enjoys spending time with her husband, two children, and rescue dog in the Hudson Valley region of New York. Ms. Russell holds the Certified ETF Advisor (CETF) designation with the ETF Institute and a Bachelor of Arts from Cornell University, where she competed in NCAA Division I Rowing and graduated with honors.

Daniel Schramm, Government Relations Specialist, OCC

Daniel Schramm works in the government relations department at The Options Clearing Corporation, the world’s largest equity derivatives clearing organization. In this role, Mr. Schramm builds and maintains relationships with congressional policymakers and their staff, advocating on issues of importance to OCC and the exchange-traded options industry. Prior to joining OCC, Mr. Schramm worked as a policy fellow in the office of Senator Ron Wyden (D-OR) covering issues including international trade and environmental protection. Before working on Capitol Hill, Mr. Schramm’s earlier career included roles working at a nonprofit that focused on environmental conservation and working for a Miami-Dade County Commissioner.

Mr. Schramm holds a bachelor’s degree from Florida International University where he studied political science, international relations and economics.

Patty Schuler, Senior Vice President of Business Development, BOX Options Market

Patty Schuler joined BOX in 2011 and is the Senior Vice President of Business Development focusing on market structure, competitive strategy, and client relations at BOX. Ms. Schuler started her career on the floor of the Chicago Board Options Exchange in 1986. She spent numerous years working for various member firms in several capacities from runner to crowd clerk, to institutional/retail phone clerk and floor manager. In 1997 she started with PAX Clearing Corporation as a manager and oversaw the daily stock and options trading floor operations on the CBOE, AMEX, PHLX, and PCX. She was instrumental in developing the firm’s front-end stock and options trading platform. In 2004, Ms. Schuler became Director of Business Development for CBOE and CBOE Stock Exchange. She earned her Bachelor of Arts degree in business administration from DePaul University.

Jennifer Setzenfand, Vice President, Senior Trader of Global Equities and Derivatives, Federated Hermes

Jennifer Setzenfand is a Vice President and Senior Global Derivative & Equity Trader at Federated Hermes in Pittsburgh. Responsible for trading global derivatives and equities, including, options, ETFs, futures, swaps, convertible securities, OTC, and structured products, she has been at the firm since 1997. Prior to Federated Hemes, Ms. Setzenfand was a Market Maker at Mayer & Schweitzer in Chicago. She is a Past Chairman (2012) of the Security Traders Association and a Past President (2005) of the Pittsburgh Society of Investment Professionals. Ms. Setzenfand holds a B.A. in finance from Ohio University.

Bryan Smith, Senior Vice President, Complex Investigations, and Intelligence, FINRA

Bryan Smith currently serves as FINRA’s Senior Vice President as part of the National Cause and Financial Crimes Detection (NCFC) program. In this role, he oversees the Cyber and Analytics group, which houses FINRA’s Cyber-Enabled Fraud, Cyber Security, and the Crypto Asset Investigations Group.

He also oversees the Illicit Finance & Fraud group, composed of the Anti-Money Laundering Teams, Anti-Fraud Investigative Team, High Risk Representative Group, and the Vulnerable Adults and Seniors Investigation Team. Mr. Smith is also responsible for U.S law enforcement engagement.

Prior to joining FINRA, Mr. Smith spent more than 21 years with the FBI as a Special Agent and most recently was the Section Chief for the FBI’s Cyber Criminal Operations, responsible for the FBI’s investigations and operations against cyber-criminal actors and threats. Previous FBI leadership assignments included leading the Cyber/White Collar branch of the Cleveland office, the FBI’s national money laundering/bank fraud program, and serving as the FBI Detailee to the U.S. Securities and Exchange Commission, where he assisted both agencies in insider trading, market manipulation, and investment fraud matters.

His experience crosses over financial crimes, cyber, and virtual currency. In 2013, he initiated the FBI’s first unit focused on cryptocurrency. A proponent of public private partnerships, he initiated several private sector outreach efforts to better leverage the complementary knowledge of both. Prior to the FBI, he was a consultant for Accenture and Deloitte and graduated from Bradley University with a degree in Accounting.

Eric Stockland, Managing Director, Co-Head of Global Electronic Trading, BMO Capital Markets

Eric Stockland joined BMO in 2020 and has been responsible for BMO’s electronic trading institutional quantitative strategy globally. A thought-leader and industry veteran, Mr. Stockland has over 22 years of experience in trading, capital markets technology, and exchange operations. Before joining BMO Capital Markets, he served as IEX’s Chief Strategy Officer. Mr. Stockland led product development, quantitative research and business development teams at various times during his 4-year tenure with the company. Prior to IEX, he was an execution consultant at KCG, a trader at GETCO and he began his career at Archipelago (now NYSE Arca).

Douglas Yones, Head of Exchange Traded Products, NYSE

Douglas Yones is currently the Head of Exchange Traded Products at the New York Stock Exchange, where he oversees the team responsible for the delivery of customized, full service end-to-end capabilities for ETP and Closed End Fund Issuers. From the moment an asset manager begins developing their product, the team at NYSE can help to drive product and index development, regulatory guidance and legal support, an unparalleled listing day experience, and long term enhancement of product growth and distribution alongside superior market quality and liquidity.

Prior to joining the NYSE, Douglas spent 17 years at The Vanguard Group, most recently as the Head of Domestic Equity Indexing/ETFs.

Jim Toes, President and CEO, Security Traders Association

Jim Toes has served as President and CEO of Security Traders Association (STA) since 2011. In this role, Mr. Toes maintains STA’s relationship with U.S. regulators and congressional policymakers, advocating for the employees and customers of the financial markets. Under Mr. Toes’ leadership, STA has written more than 50 comment letters on a wide range of issues under the regulatory oversight of the U.S. Securities and Exchange Commission, Department of Treasury, Commodities and Futures Trading Commission (CFTC), FINRA, and the Senate and House Financial Services Committees. In addition, Mr. Toes has penned close to 100 articles on current events and human interest stories that resonate well with individual members and align with STA’s core principles.

Mr. Toes has nearly 35 years of experience in the securities business, particularly within equity and options sales, trading, and clearing. Prior to joining STA, Mr. Toes was a Managing Director at Bank of America Merrill Lynch for 18 years, where he held various management positions, interacting with a broad range of clients including institutional and middle market asset managers, broker-dealers, and retail investors. Over the course of his career, Mr. Toes has also used his breadth of market structure knowledge to serve on various best execution and market structure committees and has testified before Congress. As a past President of the Security Traders Association of New York and a former Governor and Secretary of STA, Mr. Toes has a deep understanding of the STA organization and the vital role its 24 Affiliate organizations in North America play in the success and mission of the Association.